- Report - Aug 4, 2021

Islamic banking

Build and launch Shari'ah-compliant financial solutions with Mambu’s advanced cloud-native banking technology. Our flexible, composable platform allows you to build and launch the products needed to meet demand.

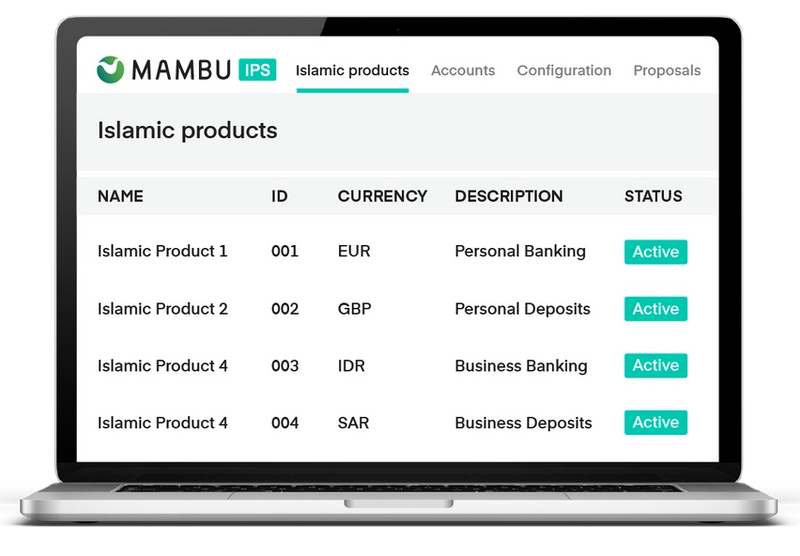

Our Islamic funding products

Build and launch Shari'ah-compliant funding products to delight your customers with modern and convenient banking experiences.

Wadiah

Provide a 100% Shari'ah compliant account and a worry-free way for your customers to safeguard their wealth.

- No overdrafts, fees, or charges

- Potential of a gracious hibah (gift)

- Financial practices aligned with your customers' beliefs

Qard Hassan

Offer the flexibility and convenience of a current account without any profit or loss sharing.

- Peace of mind

- Deposits are always secure

- Reward loyalty customers with a discretionary hibah (gift)

Tawarruq

Give your customers a smart and convenient way to invest their money and earn a fixed return.

- Flexibility to choose from a variety of deposits and savings accounts

- Match financial needs with ambitions

Mudarabah

Offer your customers an opportunity to deposit funds and share in the potential profits on an investment.

- Share investment performance

- Share in the benefits of your professional management expertise

- Returns are not fixed or guaranteed

Wakala

Provide customers with a lower-risk investment option and opportunity to earn a return on their deposits at an agreed cap rate.

- Certainty of a fixed return

- Opportunity to benefit from your investment expertise

- 100% Shari'ah-compliant

LATEST REPORT

The shape of Islamic finance in 2024

The increasing demand for Islamic banking products has created a large opportunity for banks and lenders around the world.

With 86% of millennial and Gen Z Muslims stressing the importance of ethical investments, banks now need to ensure they explore further ethical products and services to draw in more Muslim and ethical consumers.

Our latest report looks at how Islamic financial institutions can gain greater agility and speed.

Innovation meets traditional values

Innovative products

Design and launch a range of Islamic funding products tailored to the diverse needs of modern customers, ensuring compliance, convenience, and customer satisfaction.

Robust profit sharing

Our reliable and secure Islamic Profit Sharing capabilities enable the calculation, approval and distribution of profit on deposit accounts so that you can offer Shari'ah-compliant products.

Ethical financial practices

Ensure full compliance with Islamic law and Shari'ah rules and guidelines at every step. Mambu helps you to serve customers with practices aligned to ethical values.

Why Mambu?

Innovate at speed

Design, build, and launch Islamic funding products with our platform that is always up to date and compliant with the latest regulations to ensure faster time-to-market.

More on composable banking

Cloud-native flexibility

Scale up or down as needed with our cloud-native platform that can handle high volumes of transactions and data, and adapt to changing customer needs and market demands.

Learn about a multi-cloud approach

Delightful experiences

Deliver modern and personalised financial experiences with our Islamic banking solution, which allows you to create customised products to meet customer needs and preferences.

Explore our cloud banking platform

Recommended reading