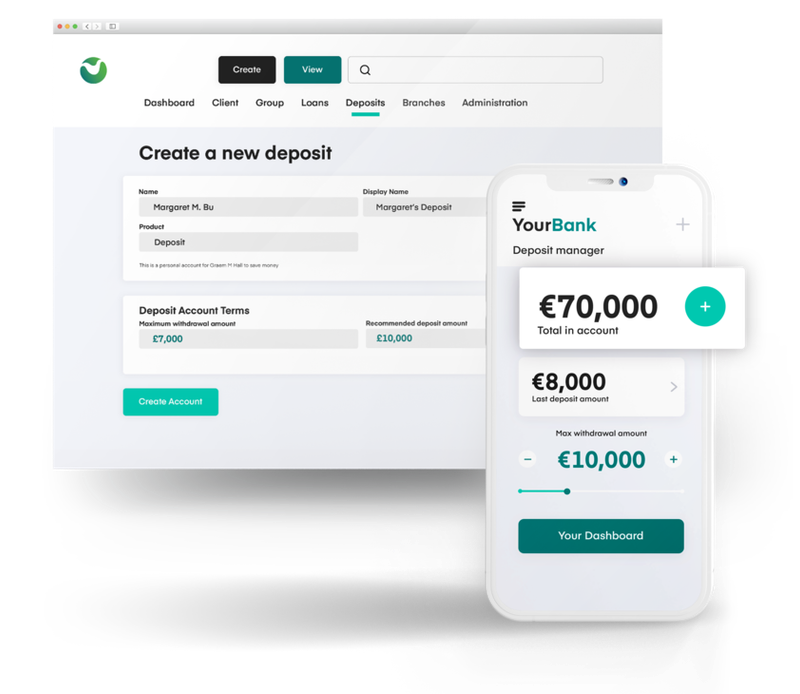

Modernise deposits

Harness the power of cloud-native technology, pre-built configurations and a composable approach to tailor your consumer and business banking portfolios. With a core banking platform from Mambu, you’ll enable faster and more efficient products for financial innovation.

Innovative. Flexible. Extendible.

Experience next-generation core banking solutions by leveraging Mambu’s composable approach.

Innovate at speed

Create, customise and launch innovative transactional banking, deposit, and savings products that meet the expectations of your customers.

Build & scale

Leverage the power and flexibility of our cloud-native technology and composable approach to build and scale your savings and deposit portfolio.

Connect & integrate

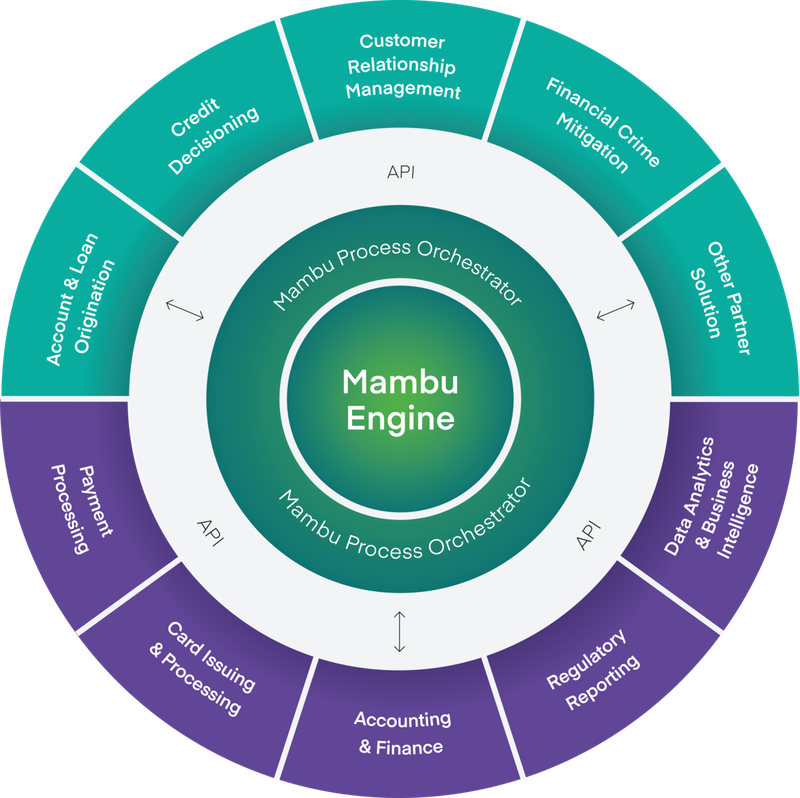

Connect and integrate with a rich ecosystem of technology partners to enhance your value proposition and customer experience.

We provide the foundation

Compose your perfect banking business

Tailor your financial offerings across five product categories available in our core banking platform.

- Personal banking

Daily transactional banking accounts for personal use with debit card and overdraft support. Also known as current or checking accounts. - Business banking

Daily transactional banking accounts for business use with debit card and overdraft support. Also known as current or checking accounts. - Stored value accounts

Subset of current account functionalities for offering digital wallets or gift cards. - Personal deposits

Savings accounts for personal use with interest bearing capabilities. - Business deposits

Savings accounts for business use with interest bearing capabilities.

Thousands of use cases

Transactional core banking and deposit products

See Mambu in action

Join our monthly live demo for a behind the scene look of our cloud banking platform.

Deposits made easy

Flexible savings

Simplify the handling of savings plans and maturity terms, providing full support for both positive and negative interest rate calculations, fixed, indexed and tiered banding, tax withholding or enforcing maximum account balance definitions.

Flexible overdraft

Streamline the handling of arranged and technical overdrafts, provide full interest rate calculation support, levy additional overdraft fees and configure maximum overdraft limits in whichever way you need.

Stored value instruments

Mambu integrates with a broad range of connectors and software solutions that are needed to launch different types of stored value payment Instruments. Our composable approach gives businesses the freedom to take the deposit engine elements they need and integrate with preferred providers.

Custom reports & alerts

Multiple custom reporting and dashboard options to ensure that all key operational and performance metrics can be measured and tracked.

Seamless integration with world-class technology partners

Expand to new markets through scalable, low-code/no-code product configurations. Iterate and test with in-house resources and publicly available APIs to reduce development costs and connect your entire deposit and transactional ecosystem.

Connect with our extensive partner network to customise hyper-personalised banking experiences. Tailor every aspect to meet your customers' unique needs. Our network ensures flexibility and precision in crafting personalized services.

Trusted by 260+ financial organisations

Customer stories

CONTACT MAMBU TODAY